What if a building façade could be leased, just like a car? Then perhaps parts and materials would be regarded more extensively as valuable assets and handled accordingly. Blending building technologies and real estate management PhD-researcher Juan Azcarate-Aguerre addresses the feasibility of a performance-based business model for a circular building envelope. Juan: “How might energy-efficient, circular façades become more attractive to the real estate market?”

Juan graduated from TU Delft’s Faculty of Architecture and the Built Environment in 2014. His master thesis dealt with innovative business and financing mechanisms for façade construction and building renovation. Following his graduation, he was presented with the opportunity to coordinate research projects relating to sustainable building materials lifecycle management in general and the subject of his master thesis in particular. “I think it’s important to balance science and industry. This research was done in parallel to years of practical experience, including starting my own business in real estate investment and property redevelopment. Everyday challenges allowed me to understand why things are done in a certain way. Roughly five years ago what started as an industry-oriented research project branched into doctoral research.”

Incentive

The preservation of raw materials and the closing of industrial loops require a realignment of business models and incentives. How might energy-efficient, circular façades become more attractive to the real estate market? Juan started looking into Product-Service Systems (PSS) as a possible answer. “If you can only buy a car, you’ll buy one that you can afford, or you might continue to drive the old one despite its problems and inefficiencies. But what if you could lease a car that is better, more comfortable and less damaging to the environment at equal or only marginally higher lifecycle costs?” In a PSS the company that builds a façade would remain its owner and only sell services related to its use and maintenance. This model could favour the reprocessing of components and materials as the façade builder – as owner – has an economic incentive to get maximum value from them at the end of the façade’s service life. “It makes sense also because the façade builder has the technical knowhow and is more familiar with the assembly, disassembly and reassembly of its parts than a traditional building owner would be.”

Can you actually separate building ownership and façade ownership in view of existing building law?

Traps and clams

Similar models have been tried and practiced in other industrial sectors, says Juan. “Mitsubishi has been offering vertical mobility services instead of selling its elevators.” Leasing an elevator is of course not the same as leasing an entire building envelope. For one thing, its integration with other building components and services makes the facade a much trickier business and legal case. What exactly are the services rendered, for instance? Who is to render them and how can responsibility be assigned? “Initially my research focused on the readiness of façade technologies relating to indoor comfort, energy performance, disassembly and the potential for reuse. But I soon moved on to legal and administrative traps and clams. Can you actually separate building ownership and façade ownership in view of existing building law? How might such a system be financed, for instance with respect to pre-financing and the provision of sufficient warranties for parties who are involved for decades?”

Ideal case study

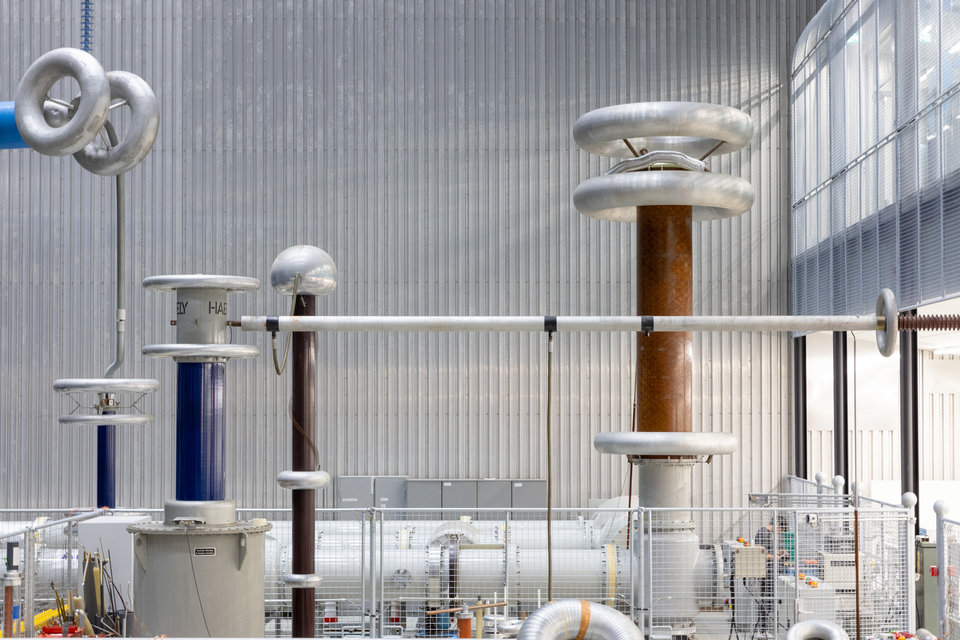

Juan was fortunate enough to be able to conduct his research and arrive at his analyses in conjunction with two pilot projects on campus. “We were able to have several system suppliers showcase different technologies on the façade of the Faculty of Electrical Engineering, Mathematics and Computer Science building. This mock-up first boosted the dialogue between stakeholders on conditions for a performance-based business case.” When another faculty building façade, that of Civil Engineering and Geosciences, became subject to extensive renovation works, the university seriously considered the notion of a Product-Service System. “I was presented with an ideal case study, including a large budget, expert involvement from academia and industry, and real-life consequences. All the stakeholders discussing the required performance, maintenance and conditions for financing enabled me to pinpoint pros and cons from different perspectives and establish the current overall feasibility of such a system.” Although in the end the university did not opt for a full Façade-as-a-Service contract, the project yielded several pioneering insights and methods. “In my thesis I list a number of recommendations for early adopters drawn from this case.”

No ready answers

All in all, Juan found that there are organisational rather than technical issues which need to be resolved. How are disputes related to the delivered performance avoided, for example when the building is used in a suboptimal way? Who’s going to remove the façade at the end of its service life and find a new application for its components? How does one reliably estimate the residual value of a façade, like we would when setting up a car lease? “There are no ready answers. Although there are pioneering projects out there and the industry is moving towards alternative business models, much ground still needs to be covered.”

This story is published: June 2023

More information

Juan Azcarate-Aguerre will defend his PhD thesis 'Façades-as-a-service: A cross-disciplinary model for the (re)development of circular building envelopes' on 20 June.