CRE alignment & Adding value

Aligning the dynamic demand and the relative static supply is a continuous focus in our research.

One of the big challenges in corporate real estate management (CREM) is to reduce the gap between the high speed of business development and the slow speed of CRE response to the business’ changing accommodation needs. This can be considered a specific case of the gap between the so-called dynamic real estate demand and the relatively static real estate supply. Hans de Jonge, Peter Krumm and Geert Dewulf in their book Successful Corporate Real Estate Strategies provide the following CREM definition: “CREM is the management of the real estate portfolio of a corporation by aligning this portfolio to the needs of the core business, in order to obtain maximum added value for the business and to contribute optimally to the overall performance of the organisation”. Since then CRE management and alignment has been the focus of our research.

Selected publications:

Krumm, PJMM 1999, 'Corporate real estate management in multinational corporations. A comparative analysis of Dutch corporations', Doctor of Philosophy, Delft University of Technology, Nieuwegein.

Dewulf, GPMR, Krumm, PJMM & de Jonge, H 2000, Succesful Corporate Real Estate Strategies. Arko Publishers, Nieuwegein.

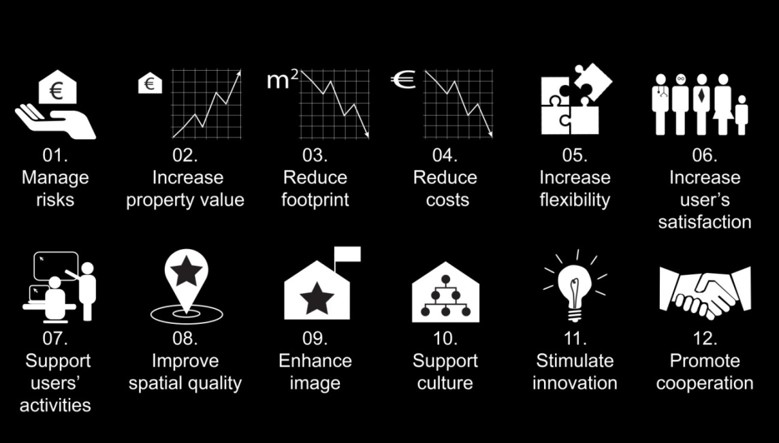

Van der Voordt, T & Jensen, PA (eds) 2016, Facilities Management and Corporate Real Estate Management as Value Drivers: How to measure and manage adding value. Routledge - Taylor & Francis Group, London.

Heywood, C & Arkesteijn, M 2017, 'Alignment and theory in Corporate Real Estate alignment models' International Journal of Strategic Property Management, vol 21, no. 2, pp. 144-158. DOI: 10.3846/1648715X.2016.1255274

Arkesteijn, M, Binnekamp, R & De Jonge, H 2017, 'Improving decision making in CRE alignment, by using a preference-based accommodation strategy design approach' Journal of Corporate Real Estate, vol 19, no. 4, pp. 239-264. DOI: 10.1108/JCRE-10-2016-0033